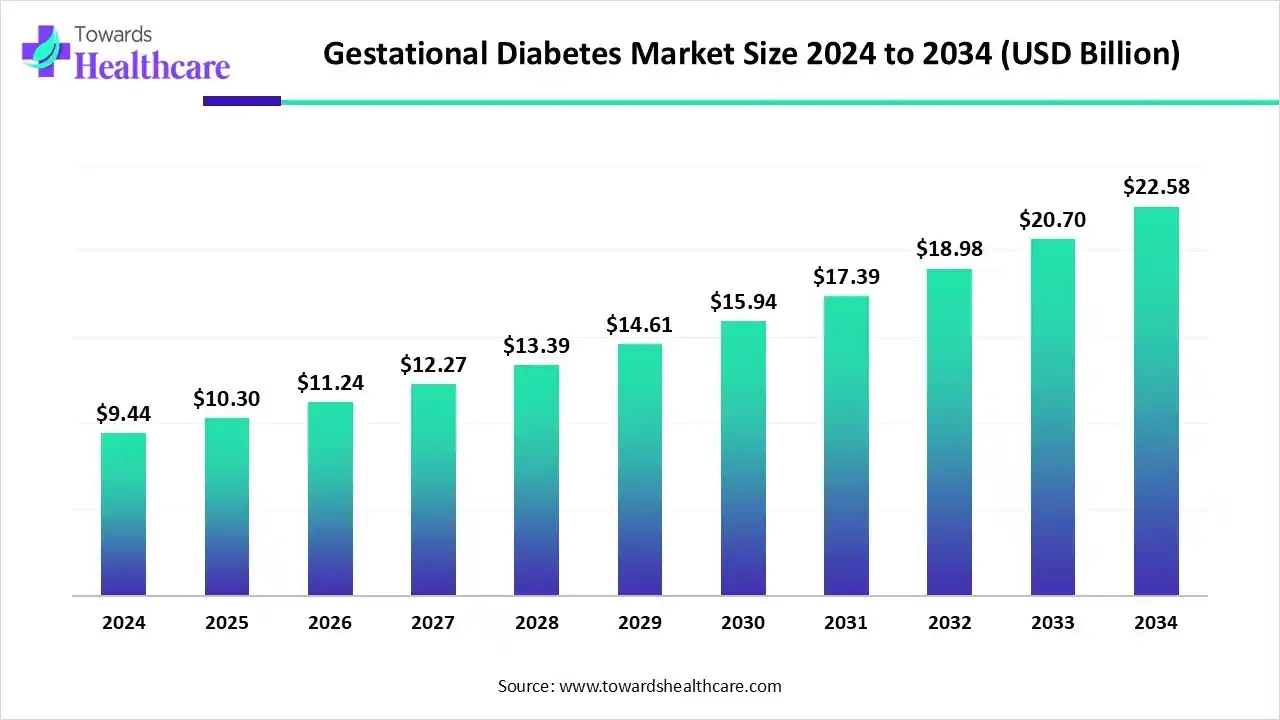

Gestational Diabetes Market to Reach USD 22.58 Billion by 2034, Driven by Rising Awareness and Rapid Innovations

The global gestational diabetes market size was valued at USD 9.44 billion in 2024 and is predicted to hit around USD 22.58 billion by 2034, rising at a 9.15% CAGR, a study published by Towards Healthcare a sister firm of Precedence Research.

Ottawa, Dec. 11, 2025 (GLOBE NEWSWIRE) -- The global gestational diabetes market size is calculated at USD 10.3 billion in 2025 and is expected to reach around USD 22.58 billion by 2034, growing at a CAGR of 9.15% for the forecasted period, driven by increasing awareness and growing innovations.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report @ https://www.towardshealthcare.com/download-sample/6401

Key Takeaways

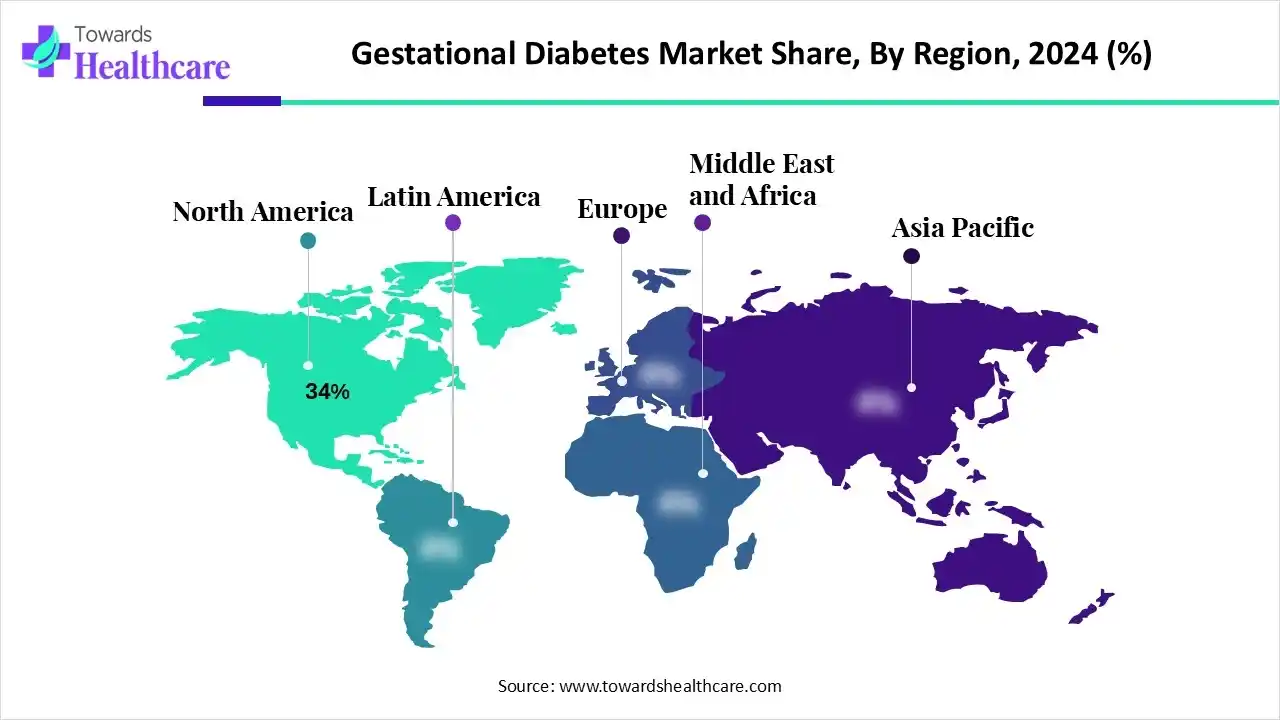

- North America dominated the market share by 34% in 2024.

- Asia-Pacific is expected to witness the fastest growth in the gestational diabetes market during the forecast period.

- By treatment type, the lifestyle & medical nutrition therapy (MNT) segment held a major revenue share of the market in 2025.

- By treatment type, the insulin therapy segment is expected to be the fastest-growing in the market during the forecast period.

- By product/drug formulation, the insulin injectables segment held a major revenue share of the market in 2025.

- By product/drug formulation, the glucose monitoring devices & consumables segment is expected to be the fastest-growing in the market during the forecast period.

- By dosage form/delivery device, the prefilled pens/pen cartridges segment held a major revenue share of the market in 2025.

- By dosage form/delivery device, the CGM sensors/consumables segment is expected to be the fastest-growing in the market during the forecast period.

- By diagnostic & monitoring method, the oral glucose tolerance test (OGTT) segment held a major revenue share of the market in 2025.

- By diagnostic & monitoring method, the CGM (real-time & intermittent) segment is expected to be the fastest-growing in the market during the forecast period.

- By end-user/care provider, the hospitals & maternity centers segment held a major revenue share of the market in 2025.

- By end-user/care provider, the home care/self-management segment is expected to be the fastest-growing in the market during the forecast period.

- By distribution channel, the retail pharmacies segment held a major revenue share of the market in 2025.

- By distribution channel, the direct-to-patient/home delivery segment is expected to be the fastest-growing in the market during the forecast period.

What is Gestational Diabetes?

The gestational diabetes market is driven by its increasing incidence due to growing obesity rates and advanced maternal age. Gestational diabetes refers to the type of diabetes that develops during pregnancy. It may lead to major complications for the mother and baby, such as the chances of caesarean delivery, preeclampsia, macrosomia, etc., which drives the demand for various diagnostic and treatment approaches.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

What are the Major Growth Drivers in the Gestational Diabetes Market?

Growing awareness is the major growth driver in the market. This, in turn, is increasing the early diagnosis of gestational diabetes patients, where the routine checkups are also contributing to the same, which is increasing the demand for effective treatment and accurate diagnostics. Additionally, growing advanced therapies, government initiatives, and technological advancements are other market drivers.

What are the Key Drifts in the Gestational Diabetes Market?

The market has been expanding due to the growing funding to enhance their R&D and launch various gestational diabetes treatment and diagnostic approaches.

- In October 2025, to examine gestational diabetes among pregnant women with diverse backgrounds and study its effect on the vascular health of mothers and their children, research will be conducted, which will be supported by a total of £400,000 in funding secured by the University of Bradford.

What is the Significant Challenge in the Gestational Diabetes Market?

Safety concerns act as the major challenge in the market. Due to the fetal risk associated with the oral antidiabetic treatment options, their use is avoided. Additionally, high treatment costs, low patient adherence, and a lack of proper reimbursement policies are other market restraints.

Regional Analysis

Why did North America Dominate the Gestational Diabetes Market in 2025?

In 2024, North America captured the biggest revenue share by 34% in the market, due to the presence of a well-developed healthcare sector. The growth in awareness and their increased incidence rates also enhanced their early diagnosis, which was supported by the reimbursement policies. The industries are also contributing to the market growth by developing innovative solutions for their management, which are backed by healthcare investment.

What Made the Asia Pacific Grow Rapidly in the Gestational Diabetes Market in 2025?

Asia Pacific is expected to host the fastest-growing market during the forecast period, due to growing incidences of gestational diabetes mellitus. The growing government initiative are increasing their early diagnosis and promoting their effective treatment. The industries are also developing various treatments and diagnostic devices, which are enhancing the market growth.

Become a valued research partner with us - https://www.towardshealthcare.com/schedule-meeting

Segmental Insights

By treatment type analysis

Why Did the Lifestyle & Medical Nutrition Therapy (MNT) Segment Dominate in the Gestational Diabetes Market in 2025?

By treatment type, the lifestyle & medical nutrition therapy (MNT) segment led the market in 2025, as it was considered as first-line treatment option. It provided high effectiveness, which increased their acceptance rates. Moreover, their non-invasive approach and enhanced safety increased their use.

By treatment type, the insulin therapy segment is expected to show the highest growth during the predicted time, due to growing gestational diabetes cases. This, in turn, is driving the development of novel insulin formulations. Additionally, increasing awareness is also increasing their use.

By product/drug formulation analysis

Which Product/Drug Formulation Type Segment Held the Dominating Share of the Gestational Diabetes Market in 2025?

By product/drug formulation, the insulin injectables segment held the dominating share of the market in 2025, driven by their high efficacy and safety. Moreover, their widespread availability also increased their adoption rates. Additionally, the growth in drug delivery devices has also increased their acceptance rates.

By product/drug formulation, the glucose monitoring devices & consumables segment is expected to show the fastest growth rate during the predicted time, due to growing early diagnosis. At the same time, the growing innovations are also increasing their use for accurate drug delivery.

By dosage form/delivery device analysis

What Made Prefilled Pens/Pen Cartridges the Dominant Segment in the Gestational Diabetes Market in 2025?

By dosage form/delivery device, the prefilled pens/pen cartridges segment led the market in 2025, as they enhanced patient convenience. They also offer dosage accuracy, which enhances the safety profile and increases their use. Furthermore, their enhanced availability also increased the patient adherence rates.

By dosage form/delivery device, the CGM sensors/consumables segment is expected to show the highest growth during the predicted time, driven by growing real-time glucose monitoring. This, in turn, is enhancing patient convenience, which is increasing their use. Additionally, increasing innovations are also driving their adoption rates.

By diagnostic & monitoring method analysis

How the Oral Glucose Tolerance Test (OGTT) Segment Dominated the Gestational Diabetes Market in 2025?

By diagnostic & monitoring method, the oral glucose tolerance test (OGTT) segment held the largest share of the market in 2025, due to its compliance with regulatory standards. As it was a mandatory diagnostic tool, its use increased, where its high sensitivity and specificity also promoted its adoption rate.

By diagnostic & monitoring method, the CGM (real-time & intermittent) segment is expected to show the fastest growth rate during the upcoming years, due to growing demand for real-time glucose monitoring. Moreover, their growing integration with mobile apps and increasing development of sensors are also driving their acceptance rates.

Get the latest insights on life science industry segmentation with our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership

By end-user/care provider analysis

Why Did the Hospitals & Maternity Centers Segment Dominate in the Gestational Diabetes Market in 2025?

By end-user/care provider, the hospitals & maternity centers segment led the market in 2025, as they are the primary centers. The growth in the patient volume and presence of specialized staff also increased their acceptance rates. Furthermore, the use of advanced solutions and patient monitoring also increased dependence on them.

By end-user/care provider, the home care/self-management segment is expected to show the highest growth during the upcoming years, due to growing interest in remote monitoring. The growing telehealth platforms and digital tools are also increasing their use for effective management of gestational diabetes, which is increasing patient convenience.

By distribution channel analysis

What Made Retail Pharmacies the Dominant Segment in the Gestational Diabetes Market in 2025?

By distribution channel, the retail pharmacies segment dominated the market in 2025, due to their widespread availability. At the same time, they also offered a variety of products, which increased their reliability. Additionally, the presence of OTC products also enhanced the patient adherence rates.

By distribution channel, the direct-to-patient/home delivery segment is expected to show the fastest growth rate during the upcoming years, as it offers enhanced convenience and reduces the number of hospital visits. Furthermore, the growing online platforms are also increasing their delivery in remote areas, increasing their acceptance rates.

Browse More Insights of Towards Healthcare:

The U.S. compounding pharmacy market size in 2024 was US$ 6.57 billion, expected to grow to US$ 6.98 billion in 2025 and further to US$ 12.02 billion by 2034, backed by a robust CAGR of 6.24% between 2025 and 2034.

The birth control pills market size was reported at US$ 19.48 billion in 2025 and is expected to rise to US$ 20.38 billion in 2026. According to forecasts, it will grow at a CAGR of 4.63% to reach US$ 30.63 billion by 2035.

The hyperkalemia drugs market size was reported at US$ 1.42 billion in 2025 and is expected to rise to US$ 1.62 billion in 2026. According to forecasts, it will grow at a CAGR of 13.84% to reach US$ 5.20 billion by 2035.

The antitumor ADC drugs market size stood at US$ 7.38 billion in 2025, grew to US$ 8.33 billion in 2026, and is forecast to reach US$ 24.75 billion by 2035, expanding at a CAGR of 12.86% from 2026 to 2035.

The global AI in pharmaceuticals market size is calculated at US$ 1.97 billion in 2025, grew to US$ 2.5 billion in 2026, and is projected to reach around US$ 21.51 billion by 2035. The market is expanding at a CAGR of 27.01% between 2026 and 2035.

The global cancer supportive care drugs market size is calculated at US$ 21.89 billion in 2024, grew to US$ 22.36 billion in 2025, and is projected to reach around US$ 27.05 billion by 2034. The market is expanding at a CAGR of 2.14% between 2025 and 2034.

The global cardiovascular drugs market size is calculated at US$ 150.02 billion in 2024, grew to US$155.53 billion in 2025, and is projected to reach around US$ 213.36 billion by 2034. The market is expanding at a CAGR of 3.65% between 2025 and 2034.

The U.S. pharmaceutical market size is calculated at USD 520.4 billion in 2025, grew to USD 553.55 billion in 2026, and is projected to reach around USD 965 billion by 2035. The market is expanding at a CAGR of 6.37% between 2026 and 2035.

The global small molecule API market size is calculated at US$ 206.9 billion in 2025, grew to US$ 219.52 billion in 2026, and is projected to reach around US$ 374.03 billion by 2035. The market is expanding at a CAGR of 6.1% between 2026 and 2035.

The global inhalation and nasal spray generic drugs market size was US$ 25.18 billion in 2025, grew to US$ 27.44 billion in 2026, and is projected to reach around US$ 59.35 billion by 2035. The market is expected to expand at a CAGR of 8.99% between 2026 and 2035.

Recent Developments in the Gestational Diabetes Market

- In November 2025, the first global guidelines to reduce the gestational diabetes complications, such as birth injuries, cardiometabolic diseases, pre-eclampsia, and stillbirth, were released by the World Health Organization (WHO).

- In November 2025, to prevent Gestational Diabetes Mellitus (GDM) in pregnant women, a pilot study was launched, which was announced by the Health Minister, Ma Subramanian.

Gestational Diabetes Market Key Players List

- Johnson & Johnson

- F. Hoffmann-La Roche Ltd.

- Merck & Co., Inc.

- Biocon Limited

- Becton, Dickinson and Company (BD)

- AstraZeneca plc

- Ascensia Diabetes Care

- Ypsomed Holding AG

- Boehringer Ingelheim GmbH

- Nipro Diagnostics

- Insulet Corporation

- Thermo Fisher Scientific

- Tandem Diabetes Care, Inc.

- Sun Pharmaceutical Industries Ltd.

Segments Covered in The Report

By Treatment Type

- Lifestyle & Medical Nutrition Therapy

- Insulin Therapy

- Basal Insulin

- Prandial/Rapid-Acting Insulin

- Pre-mixed Insulin

- Oral Anti-diabetic Agents

- Metformin

- Sulfonylureas

- CGM & SMBG-linked Therapies

- Adjunctive Therapies/Supplements

By Product/Drug Formulation

- Insulin Injectables (pens, vials)

- Prefilled Pens/Cartridges

- Vials

- Glucose Monitoring Devices & Consumables

- RT-CGM

- Intermittent-scan CGM

- SMBG Meters & Strips

- Oral Tablets

- Digital Therapeutics & Apps

- Pumps & Consumables

- Supplements/Medical Foods

By Dosage Form/Delivery Device

- Prefilled Pens/Pen Cartridges

- Disposable Prefilled Pens

- Reusable Pens + Cartridges

- Vials (liquid)

- CGM Sensors/Consumables

- Cartridges for Pumps

- Pumps/Patch Pumps Consumables

- Novel/Inhaled/Other

By Diagnostic & Monitoring Method

- Oral Glucose Tolerance Test (OGTT)

- One-step (75 g)

- Two-step (50 g screen + OGTT)

- CGM (real-time & intermittent)

- Self-Monitoring Blood Glucose (SMBG)

- Fasting Plasma Glucose/HbA1c adjunct

- Biomarker/Point-of-Care Tests

By End-User/Care Provider

- Hospitals & Maternity Centers

- Home-Care/Self-Management

- Outpatient Clinics/Diabetes Centers

- Retail Pharmacies/Community Pharmacies

- Public Health/Community Programs

By Distribution Channel

- Retail Pharmacies

- Direct-to-Patient/Home Delivery

- Hospital/Institutional Procurement

- Online Pharmacies/E-Pharmacies

- Government/Tender Procurement

- Specialty Distributors/Others

By Region

North America

- U.S.

- Canada

- Mexico

- Rest of North America

South America

- Brazil

- Argentina

- Rest of South America

Europe

-

Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

Asia Pacific

- China

- Taiwan

- India

- Japan

- Australia and New Zealand,

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

MEA

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/checkout/6401

Access our exclusive, data-rich dashboard dedicated to the healthcare market - built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics, with a strong emphasis on life science research. Dedicated to advancing innovation in the life sciences sector, we build strategic partnerships that generate actionable insights and transformative breakthroughs. As a global strategy consulting firm, we empower life science leaders to gain a competitive edge, drive research excellence, and accelerate sustainable growth.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Europe Region: +44 778 256 0738

North America Region: +1 8044 4193 44

APAC Region: +91 9356 9282 04

Web: https://www.towardshealthcare.com

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Automotive | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.